2019 Lewis & Clark Report | Tech Between The Coasts

In 2018, the Between the Coasts (BTC) region received more attention in conversations about venture than at any point in recent memory. Given the frenzy surrounding monster fundraising rounds and valuations on the coasts (and the emerging sense of jadedness with Silicon Valley culture), it’s not a surprise that many folks have begun looking to new ecosystems for a fresh perspective. We at Lewis & Clark welcome the increased attention to our region’s strong fundamentals: our world-class research institutions, abundance of STEM graduates, bulk of the Fortune 500, and good old-fashioned grit.

But while we are extremely bullish on the BTC venture opportunity — investing here is what we do, after all — we also recognize that a sober examination of the strengths and weaknesses of the BTC region is necessary to empower sustainable innovation. With that in mind, we’re proud to present our third Tech Between the Coasts Report.

Our format this year is largely similar to last year’s report, with a few additions including examinations of corporate venture capital and exit types. We hope these new dimensions will help paint a fuller picture of the ecosystems in each region.

All reported data throughout this report comes from PitchBook. As PitchBook is a dynamic database, figures are subject to change. In future editions of the report, we hope to leverage additional sources of information to make our analysis more informed and robust.

Activity Overview*

At the highest level, comparative trends across the West, BTC, and East regions are generally in line with what we’ve seen in recent years. When reviewing deals, the West leads in terms of both number of deals and the capital involved in those deals (4,881 deals; $68.7B invested). The East follows closely behind in terms of number of deals (4,515) but lags quite a bit further behind in terms of capital invested ($37.4B). The BTC region is considerably lower by both counts, at 2,977 deals representing $13B of invested capital.

On a state-by-state basis, California, New York, and Massachusetts accounted for 53% of deals and 76% of deal value in 2018. California (i.e., Silicon Valley) drives the vast majority of the West’s deals, with the state representing 86% of deals by count and 95% of deals by invested capital. The East region is driven by two hubs: New York is responsible for 32% of deals by count and 37% of invested capital, and close behind is Massachusetts with 20% of deals and 31% of invested capital. Deals in the BTC region are much more dispersed, with Texas (24% of deals and invested capital), Colorado (12% of deals; 13% of invested capital), and Illinois (11% of deals; 14% of invested capital) leading the pack.

When it comes to exits, the West predictably leads in terms of count and exit value, with 462 exits representing a disclosed $122B in exit value. The East follows with 317 exits representing $59B. The BTC region comes in third, at 197 exits representing $30B.

The same group of states responsible for the bulk of deals also accounts for the bulk of exits in each region. California supplied 87% of the West region’s exits and 85% of exit value. New York saw 33% of exits and 16% of exit value, while Massachusetts saw 24% of exits and a whopping 51% of exit value (in a good year for biotech). The BTC region was again more dispersed, led by Texas (23% of exits representing 21% of value), Illinois (15% of exits representing 36% of value), and Colorado (11% of exits representing 12% of value).

High-level summaries of deals and exits are easy to come by. But to truly understand the emerging storylines of each region, you have to dig into historical trends, more granular data on exit types, funder dynamics, and much more. The remainder of this report aims to do that.

* Unless otherwise noted, dollar figures are medians. Due to updates to historical statistics, some figures for 2013–2017 may have changed from prior editions of the report.

Deals

Nationwide trend of fewer, but larger, deals continues

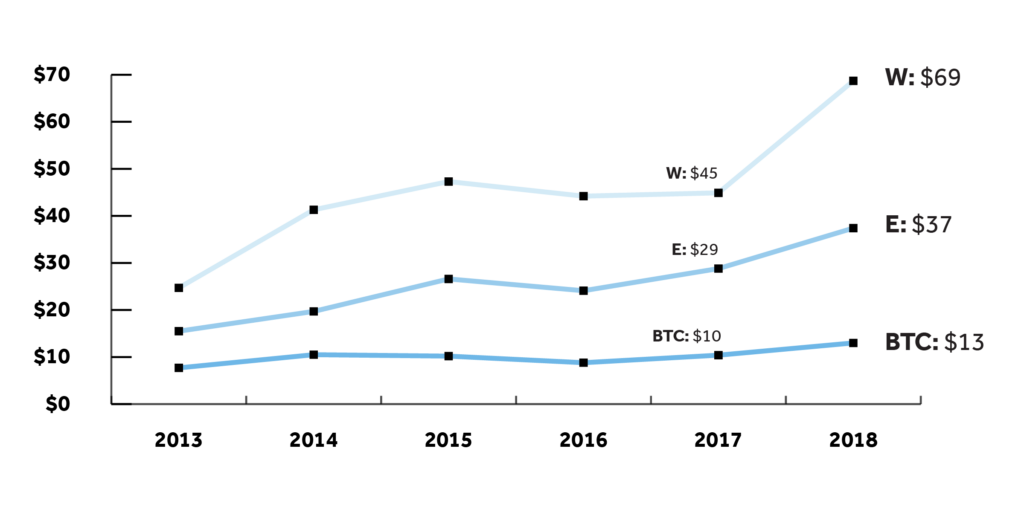

VC CAPITAL DEPLOYED OVER TIME ($B)

More capital in deals across all regions; increase most pronounced in West

When it comes to dollars deployed, each region saw at least a slight uptick in 2017. In 2018, each region experienced a significant increase, though the West far outpaced the East and BTC regions (53% increase in the West, 30% increase in the East, 25% increase in the BTC). Of the deals represented below, 126 of the West’s deals were $100M or greater, in contrast to the 58 from the East and just 14 from BTC.

VC DEALS OVER TIME

Fewer deals across all regions

In 2017, the BTC and West regions both saw a decrease in the number of deals, while the East saw a slight increase. In 2018, each region experienced roughly similar deal volume decreases on a percentage basis (12% decrease in the West, 15% decrease in the BTC, 16% decrease in the East).

BTC BREAKDOWN IN 2018

Same group of BTC states seeing vast majority of deal flow

The same cohort of 12 BTC states has made up roughly 90% of deal volume and capital deployed in recent history, and that cohort remained unchanged in 2018. There are slight differences between the positions of these top 12 states when viewed in terms of deal count as opposed to dollars, indicating that states with relatively fewer deals but more capital deployed are seeing more late-stage deal activity (e.g. Utah), and vice versa.

STAGE DYNAMICS IN 2018

BTC looking like East; East looking like West; West looking like…a bubble?

Given the overall trend of more capital deployment and fewer deals, we’d expect the average round sizes and valuations at each stage to be higher in 2018 — indeed, that’s what we see almost universally (the only exception is a ~12% decrease in BTC pre-money valuations at the seed stage, though this could be spurious). One interesting similarity among all the regions is the consistency when it comes to the percentage of the company being bought in each round (~20% in seed, ~30% in Series A, ~25% in Series B, and ~20% in Series C rounds). The most notable 2018 changes are:

A roughly 40% increase in BTC Series A round sizes and pre-money valuations compared to 2017, indicating that BTC stage dynamics at the Series A are becoming more like the coasts — something we can attest to anecdotally;

A 57% increase in East Series B round sizes and a 44% increase in East Series B pre-money valuations, aligning East Series B rounds much more closely to those we’ve seen in the West; and

A near-doubling (47% increase) in West Series C pre-money valuations, consistent with the massive valuations we’ve seen recently from Silicon Valley late-stage fundraises.

Top 10* BTC Deals In 2018**

Essence Group Holdings

$266M

Healthcare Technology

Saint Louis, MO

July 2018

OfferPad

$150M

Real Estate Services

Gilbert, AZ

May 2018

Tempus

$110M

Database Software

Chicago, IL

August 2018

Root Insurance

$100M

Automotive Insurance

Columbus, OH

November 2018

Nikola

$210M

Automotive

Salt Lake City, UT

November 2018

Welltok

$117M

Healthcare Technology

Denver, CO

April 2018

Hedera Hashgraph

$101M

Financial Software

Richardson, TX

August 2018

Bright Health

$200M

Life and Health Insurance

Minneapolis, MN

November 2018

Wunder Capital

$112M

Financial Software

Boulder, CO

April 2018

Venafi

$100M

Network Management Software

Salt Lake City, UT

November 2018

C2FO

$100M

Financial Software

Leawood, KS

February 2018

Holders

* Since the 9th, 10th, and 11th largest deals for 2019 were all reported as $100M, we actually present 11 total deals.

** Though we included all venture-stage deals in our high-level summary of deal trends, when calling out the “Top 10 Deals” above, we only included deals that fit what we consider a “traditional“ venture deal. In 2018, excluded deals include Bungalo ($250M; largely/entirely funded by one corporate entity) and Biomotiv ($146M; drug development accelerator).

Funds

Fund sizes growing across all regions

NEW VC FUNDS OVER TIME

More new funds in the BTC and East; slightly fewer in the West

2018 was another mixed year for new BTC funds, with new BTC funds making up about 20% of the number of newly announced funds nationwide. Comparing 2017 to 2018, new BTC funds increased by about 17%, compared to a 29% increase in new East funds and a 4% decrease in West funds. However, the decrease in the number of new West funds is more than made up by the increase in the size of West funds.

NEW VC ASSETS OVER TIME ($B)

Total dollars managed by new BTC funds remains low; East and West increase significantly

While all regions saw an increase in the value of assets being managed by new funds, those in the BTC region made up just 4% of the total announced assets among new funds. The jump from 2017 to 2018 was most pronounced in the East region, which grew by 77% to $18B. The West region increased by 41% to $32B, while the BTC region grew by 40% to $2B.

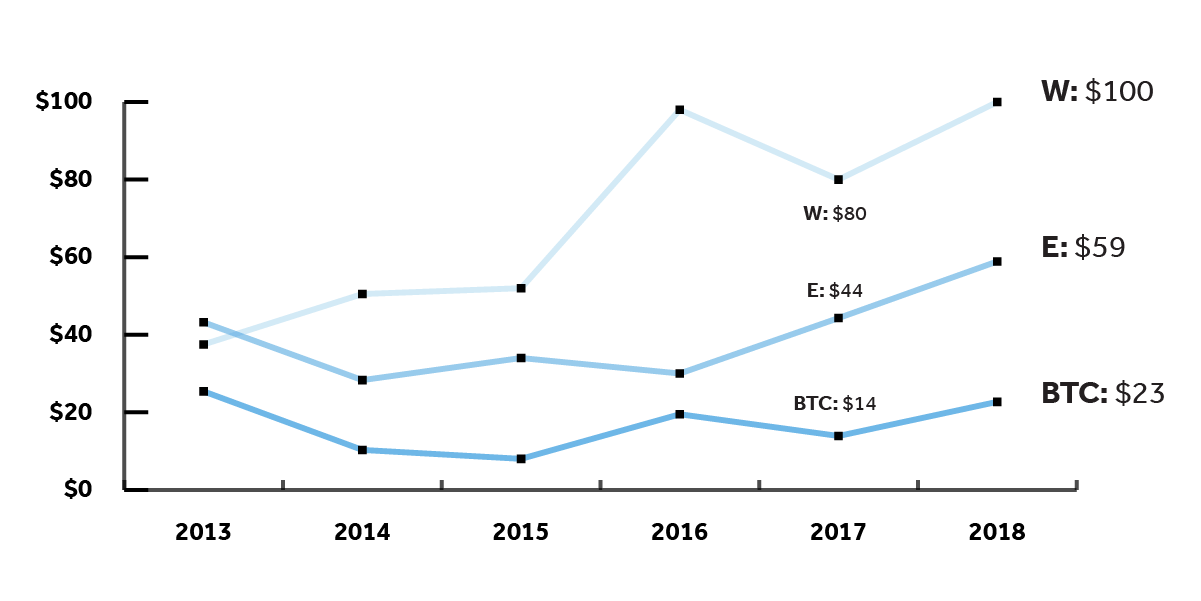

NEW VC FUND MEDIAN SIZE OVER TIME ($B)

Median fund sizes increasing in step with deal sizes across all regions

In parallel to the trends of inflating deal sizes and valuations, fund sizes are increasing nationwide as well. The median fund in the West increased by 25% to $100M between 2017 and 2018, while the median East fund increased by 33% to $59M. At 63%, the BTC region had the most significant year-over-year median fund size increase, though at just $23M, there’s still quite a bit of room for catch-up.

DEALS BY FUND REGION OVER TIME

Funds still prefer investing close to home across all regions

Each region’s bias for close-to-home deals remained largely unchanged in 2018. West and East funds both held steady at only roughly 10% of their total deals being made with BTC companies, while BTC funds did about 75% of their deals with startups in the region. West funds did about 64% of their deals with companies in the West, while East funds did just over 50% of their deals with East companies.

CORPORATE VC DEALS OVER TIME

Corporate VCs still hesitant about investing in BTC and East startups

Over the past 6 years, the percentage of deals in each region involving corporate VC (CVC) arms has remained relatively stable. In terms of number of deals, since 2013 around 3%-4% of BTC deals have involved participation from CVCs, compared to 6% in East deals and 11% among West deals.

CORPORATE VC DOLLARS OVER TIME

Corporate VCs still hesitant about investing in BTC and East startups

Since corporate involvement typically comes later in a company’s fundraising lifecycle (when they’re more mature and raising larger rounds), it’s also worth looking at the numbers not just in terms of numbers of deals, but by value. When viewed through that lens, over the past six years an astonishing 57% of West deal value4 has included CVC involvement, compared to 26% of East dollars and 16% of BTC dollars.

Given the high concentration of the Fortune 500 headquartered in the BTC region (>50%), we wonder if they may be able to play some part in “leveling the playing field” by more actively participating in venture rounds for companies also in the BTC region. It’s difficult to know to what extent they are choosing to deploy capital to coastal startups as opposed to sitting on the sidelines entirely. One could argue that perhaps CVC involvement in the BTC region is low because the quality of companies isn’t good enough for them to justify putting their dollars to work. However, consistent with last year’s report, exit trends (as demonstrated below) attest that there’s no reason to believe that BTC companies are in general of a lower grade than those on the coasts. One suggestion for corporates looking to dip their toe into the VC waters without the risk of a long-term partnership? Becoming an LP in a single- or multi-sector venture fund.

Top 10 New BTC Funds In 2018**

BuildGroup Fund I

$330M

Austin, TX

June 2018

Silverton Partners V

$108M

Austin, TX

May 2018

First Analysis Fund XIII

$91M

Chicago, IL

July 2018

RiverVest Venture Fund IV

$184M

Saint Louis, MO

December 2018

Real Estate Technology Ventures

$108M

Park City, UT

November 2018

High Alpha Capital Fund II

$85M

Indianapolis, IN

July 2018

Next Frontier Venture Fund II

$38M

Bozeman, MT

March 2018

Energize Ventures Fund

$165M

Chicago, IL

September 2018

7Wire Ventures Fund

$100M

Chicago, IL

May 2018

Kickstart Seed Fund IV

$74M

Cottonwood Heights, UT

January 2018

* Not including 2016 when rounds from Uber, Snap and Lyft, all with corporate VC involvement, drove this up to an outlier of 84% of deal value.

** Though we included all venture funds in our high-level summary of fund trends, when calling out the “Top 10 New BTC Funds” above, we only included funds that fit what we consider a “traditional“ venture fund. In 2018, excluded funds include Wisconn Valley Venture Fund (a $100M first-time corporate venture fund created as a joint venture by Advocate Aurora Health, Foxconn, Johnson Controls, and Northwestern Mutual) and Social Leverage Capital Fund III (a $50M targeted third fund that received press in 2018 but has yet to announce a close as of publication of this report in April 2019).

Exits

BTC region sees exit valuations jump; continues to lead multiples

EXITS OVER TIME

Exits roughly flat across all regions

The West was the only region that saw an increase in the number of exits in 2018, jumping by 16% to 464. In contrast, the East and BTC regions each fell by 11% (to 369) and 6% (to 200), respectively. This trend aligns with the decrease in deals done in each region in the past few years: fewer deals should result in fewer exits in subsequent years.

VALUATIONS AT EXIT OVER TIME ($M)*

BTC and East valuations jump significantly; West roughly flat

In recent history, we’ve seen relatively compressed valuations at exit among the regions, implying that while BTC startups can have a difficult time raising capital, they’re able to exit at valuations commensurate with their coastal counterparts. However, 2018 was something of an exception – in a positive way – for median exit valuations in the BTC and East regions. After ending 2017 with the lowest median valuations of each region, the East shot up by more than 130% to a whopping $243M; the BTC followed with a 47% increase to $188M, and the West increased by 9% to $169M.

There are plenty of theories as to what’s driving this. Could it be that the highest quality startups in the West are choosing to stay private longer, thus artificially depressing exit value when compared to the East and BTC? Maybe. Or could it be that potential acquirers and the public are no longer willing to foot the bill for West companies with inflated valuations? We don’t have a clear answer, but it’s something worth keeping an eye on.

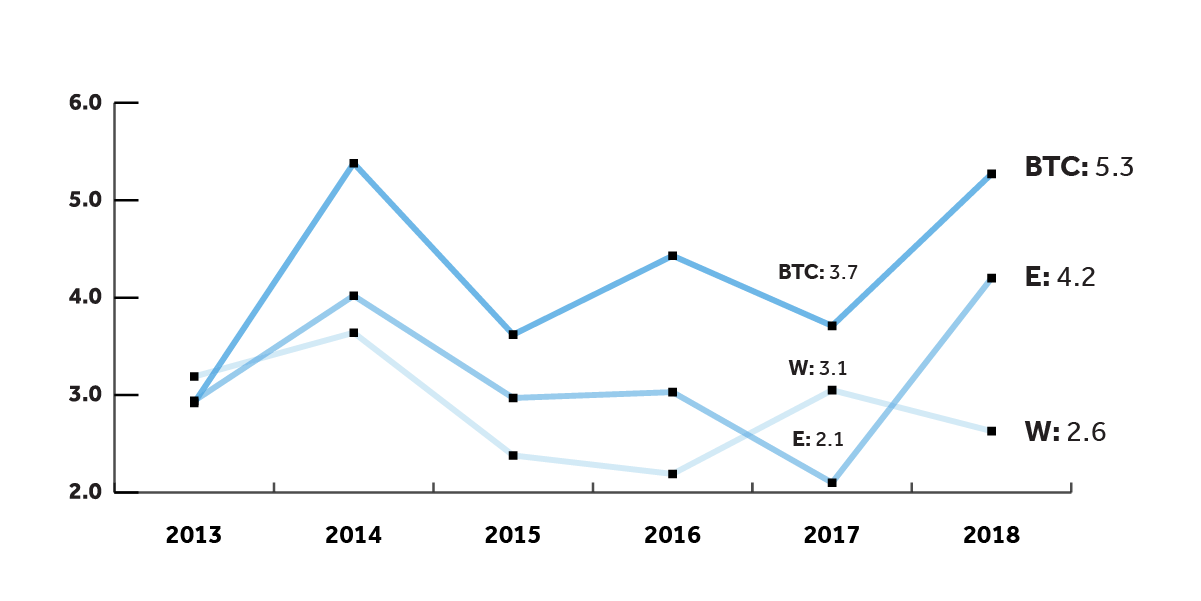

CASH-ON-CASH RETURNS OVER TIME**

BTC continues providing best multiples; East jumps significantly

The BTC region continued dominating median cash-on-cash exit multiples in 2018, increasing by about 42% year-over-year to 5.3. The East saw the biggest jump, roughly doubling to 4.2. The West lagged behind at 2.6, a 13% decrease from 2017. There are many reasons for the BTC’s strong placement among regional multiples, not least of which is the lower amount of cash it takes to build and scale a company BTC, while achieving exits roughly in line with those seen on the coasts.

EXIT TYPE BREAKDOWN IN 2018

Buyouts reign in BTC; IPOs concentrated in West and East

M&A activity drove the majority of exit activity nationwide in 2018, accounting for between 65% and 73% in each region. PE buyouts accounted for 31% of exit activity in the BTC region, compared to just 19% in the East and 17% in the West. Typically, private equity buyouts are associated with lower exit value, so it’s interesting that they made up such a large chunk of BTC exits in the same year that the BTC’s median exit value rose significantly. Perhaps the common wisdom doesn’t hold up? On the other hand, IPOs accounted for 10% in the West and 11% in the East, compared to just 5% in the BTC. Given the parade of IPOs expected in 2019 from Silicon Valley startups, we expect this disparity to grow over the next year.

Top 10 BTC Exits In 2018***

SendGrid

$3.0B | M&A

Communication Software

Denver, CO

November 2018

HomeChef

$700M | M&A

Food Delivery

Chicago, IL

June 2018

Jive Communications

$357M | M&A

Wireless Service Providers

Orem, UT

April 2018

Duo Security

$2.4B | M&A

Network Management Software

Ann Arbor, MI

October 2018

OpCity

$210M | M&A

Real Estate Software

Austin, TX

October 2018

SpareFoot

$339M | Buyout

Real Estate Software

Austin, TX

March 2018

SpringCM

$220M | M&A

Automation/Workflow Software

Chicago, IL

September 2018

Pluralsight

$2.0B | IPO*

Educational and Training Services

Farmington, UT

May 2018

Domo

$524M | IPO

Business Analytics

American Fork, UT

June 2018

WP Engine

$250M | Buyout

Internet Software

Austin, TX

January 2018

* Many companies do not disclose value at exit, particularly when the exit amount is low or from a strategic buyer. We do not try to correct for this, and thus there may be a bias of an indeterminate direction for any or all of the regions.

** We calculate cash-on-cash returns for each region assuming a theoretical company in the region raises a seed, Series A, Series B, and Series C round at the median round size in that region, before exiting at the median exit valuation in that region

*** Though we included all venture stage exits in our high level summary of exit trends, when calling out the “Top 10 Exits” above, we only included deals that fit what we consider a “traditional“ venture exit. In 2018, notable excluded deals include AveXis ($8.7B; therapeutic M&A), SolarWinds ($4.7B; lPO after take-private), ABILITY Network ($1.2B; secondary M&A), Entellus Medical ($697M; medical device IPO), Aptinyx ($521M; drug discovery IPO), Oildex ($410M; secondary acquisition), NxThera ($406M; therapeutic M&A), Inspire Medical ($324M medical device IPO), Xeris Pharmaceuticals ($296M drug developer IPO), Addiction Campuses ($275M non-tech M&A), and NeuMoDx Molecular ($234M; medical diagnostic M&A).

**** For IPOs, the number given is the valuation of the company at the time of IPO, calculated as the sale price of new stock sold at the time of IPO times the total number of company shares at that time.

Wrap Up

2018 saw a continuation of many of 2017’s venture trends. Fewer deals were done across all regions, but more capital was deployed in each. The same group of 12 BTC states accounted for the vast majority of BTC deal flow. Nearly universally, round sizes and valuations increased across all regions and company stages. In the West in particular, these massive increases are somewhat reminiscent of the dotcom bubble — let’s hope that’s not the case.

When it comes to the investor side of the equation, all regions saw increases in new funds under management and median fund size, but the BTC region remained in a distant third. Expectedly, even though there was much talk of coastal funds’ increased interest in investing BTC, each region continued deploying the bulk of its capital near home. This year we decided to dig into trends in corporate venture capital (CVC) across the regions, and found that the BTC lags far behind the coasts when it comes to CVC participation in rounds. This is partially due to CVC’s proclivity for participation in later rounds, which are relatively more scarce BTC. But more willingness on the part of the Fortune 500 — half of which are in the BTC region themselves — to take a chance on innovation in their own backyard would no doubt move the needle.

As in 2017, exits are where the BTC region truly shines. While the West was the only region that saw an increase in the number of exits, the East and BTC regions both saw huge jumps in median value at exit. The BTC region again saw the best median cash-on-cash multiple. Interestingly, the BTC region also saw the highest percentage of PE buyouts (as opposed to strategic acquisitions or IPOs), which are typically associated with lower multiples, perhaps challenging that common wisdom.

Though we seek to be fairly exhaustive when we compile this report every year, there are inevitably many fascinating trends that don’t fit neatly into our review, but help provide crucial additional context. Here are a smattering of “subplots” that emerged throughout 2018 that we thought might help tell a fuller story:10

Female founders. Using Census information, Seek Capital compiled a list of the cities with the most female entrepreneurs. The top two on their list? St. Louis, MO, and Austin, TX. Using a slightly different methodology, the Brookings Institution reviewed PitchBook data to compile the top cities by female-founded, venture-funded startups. Their top 5 were all BTC cities: Ann Arbor, Memphis, Boulder, Milwaukee, and St. Louis.

Advanced manufacturing. The Brookings Metropolitan Policy Program and the Walton Family Foundation released their State of the Heartland: Factbook 2018, in which they stressed the role that advanced manufacturing innovation will play in the continued development of BTC tech ecosystems.

Research universities and STEM. Brookings drew attention to the “Rust Belt’s” impressive research institutions (20 of the top 200 worldwide), concentration of US bachelor’s degrees (35%), and STEM degrees in particular (33%). Taken together with a CBRE analysis of tech talent throughout the country that reports Madison, Pittsburgh, and Cleveland as three of the fastest-growing talent markets, they suggest the BTC region may make particular headway in the coming years — if these cities and universities can develop an effective means of retaining their graduates.

New financing structures. A Harvard Business Review article argued that the key to unlocking potential in the BTC region may lie in new financing structures, such as “local innovation bonds” — a sort of state-insured, de-risked debt instrument for funding ideas that have a lot of potential but may not be in traditional venture investors’ sweet spot. We are certainly supportive of funding innovations for startups that aren’t a great fit for the venture path (since most startups definitely are not). But we hope that these sorts of instruments will be developed and deployed appropriately without displacing venture funding in scenarios where it truly is the best way to enable rapid growth — not just for the company, but for the wider BTC tech ecosystem.